33138 Market Update: August 2025

August 31, 2025

33138 Market Update: August 2025

This August update for Miami ZIP 33138 (Bayside, Belle Meade, Shorecrest, Palm Grove, and surrounding Upper Eastside neighborhoods) compares the most recent quarter with the preceding 12 months. The story this month is one of divergence: single-family homes remain resilient, while condos show softness under the weight of longer marketing times and increased supply.

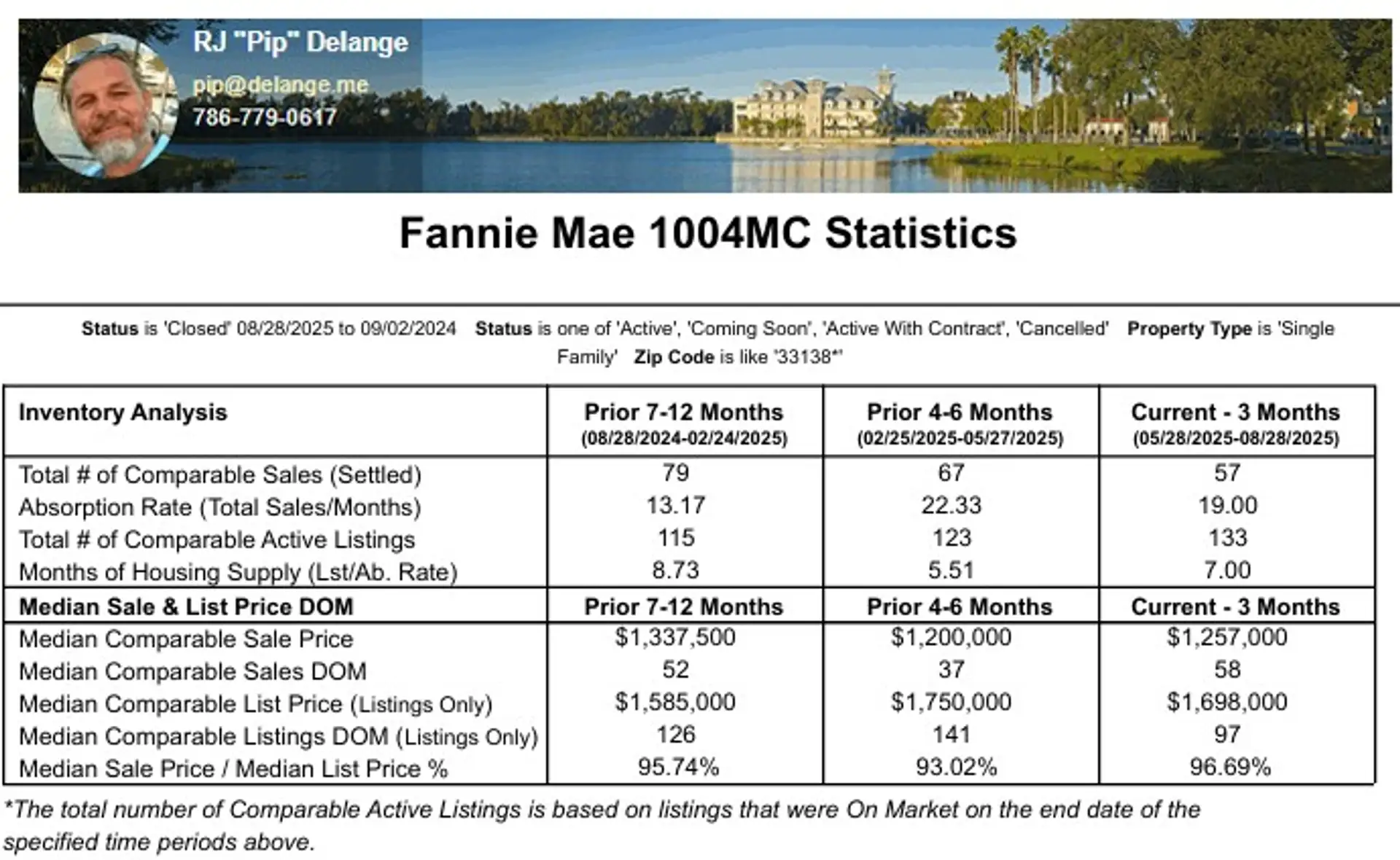

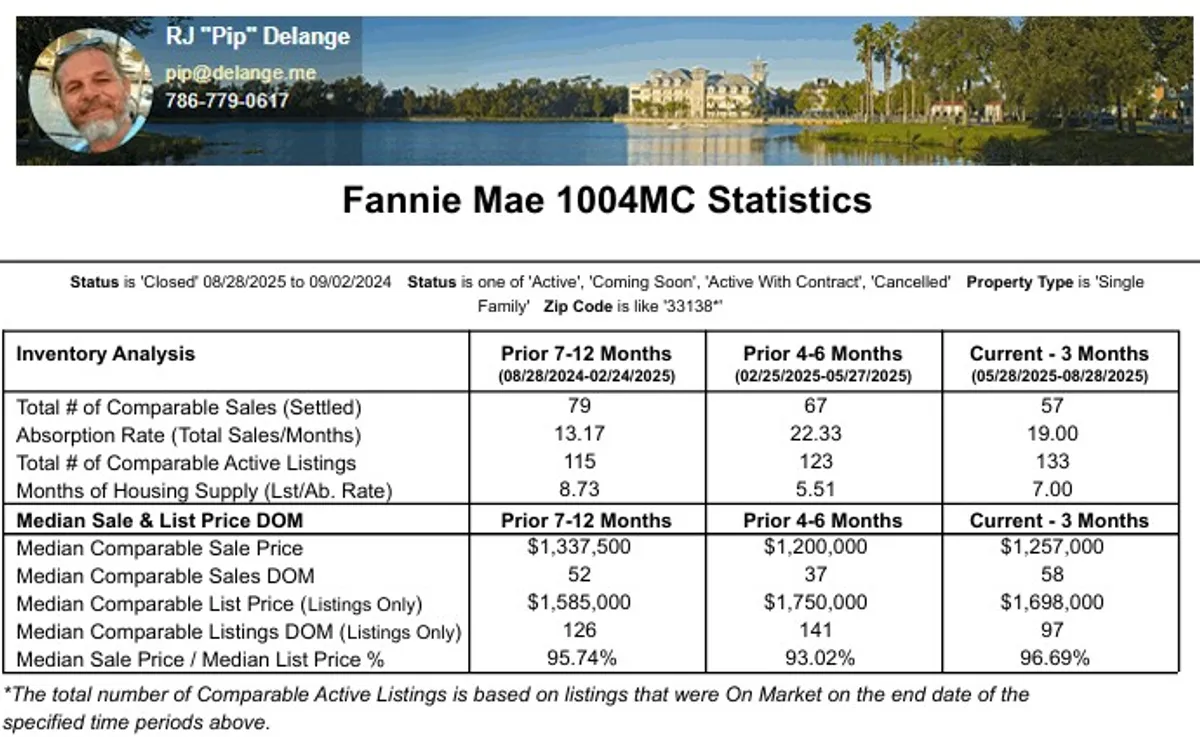

By the numbers: Reporting data for zipcode 33138

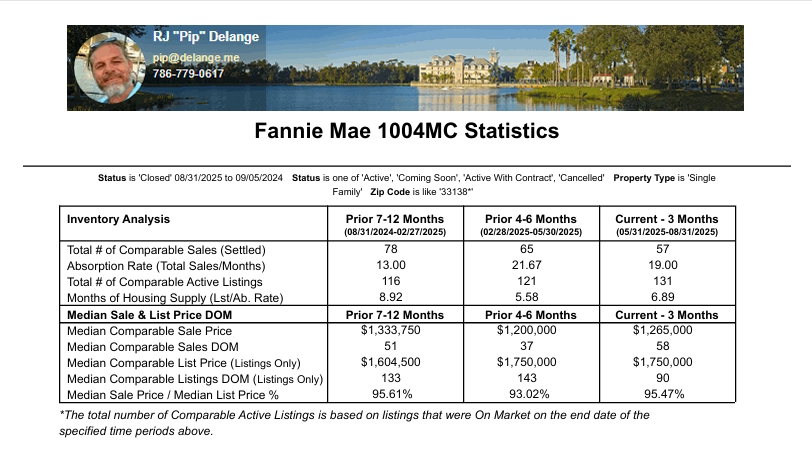

Single-Family Homes: Holding Value but With More Negotiation

Median single-family home prices settled around $1.1M in July 2025, down sharply month-over-month but still higher than last year. Estimated property values continue to show modest annual gains (+3.7% YoY), pointing to overall stability despite short-term volatility.

- Days on Market: Median just 20 days—turnkey homes sell quickly.

- Sale-to-List: Sellers are conceding ~7%, with average contracts closing at 93.2% of asking.

- List Price vs Sold Price: Active listings are marketed around $1.8M, but closed deals come in closer to $1.1M.

- $/Sqft: Ranging $539–$766 depending on condition, age, and location.

Neighborhood notes:

- Belle Meade & Bayside remain top-tier, with gated security and bay access sustaining premium pricing.

- Shorecrest is highly segmented—new-builds and luxury remodels command $2.9M+, while older stock lingers without sharper pricing.

- El Portal & Palm Grove historic homes sell best when modernized for insurance and efficiency.

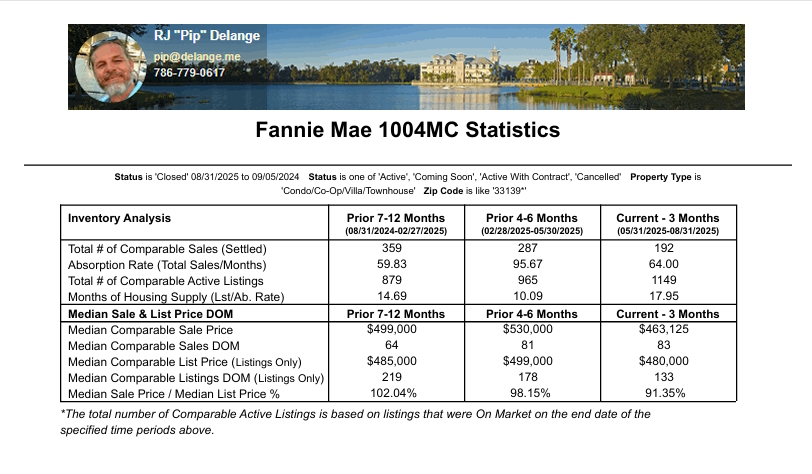

Condominiums: A Clear Buyer’s Market

Condos are showing more visible strain compared to single-family homes.

- Median Sold Price: $342,500 (down 11.6% MoM, down 7.7% YoY).

- Median List Price: $385,000, creating a widening gap between seller asks and buyer closes.

- Days on Market: Median 89 days, more than 4x slower than SFH.

- Sale-to-List: Average discounts at 7% or more.

- Distress signals: Several units in Towerside and Quayside show foreclosure or lis pendens filings.

Buyers are scrutinizing HOA reserves, flood zones, and insurance budgets earlier in the process. Lender caution has lengthened escrows, and appraisers are applying tighter risk adjustments.

Multifamily & Rentals: Investor Perspective

Small multifamily properties remain attractive to investors who want predictable cash flow and lower exposure to condo risk.

- Cap rates: Sensitive to insurance premiums, but steady for turnkey properties with separate utilities.

- Rental market: Median advertised rents in 33138 hover around $4,100/month, with top Belle Meade waterfront listings reaching $45K.

Renovated single-family homes with rental flexibility continue to outperform condos in terms of investor interest.

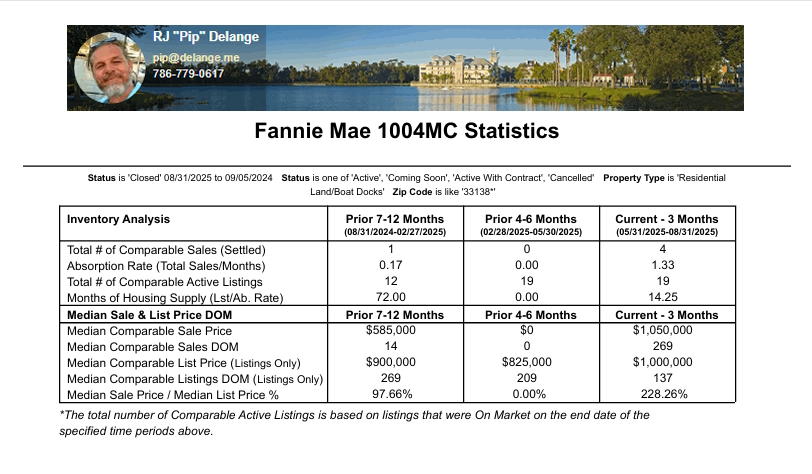

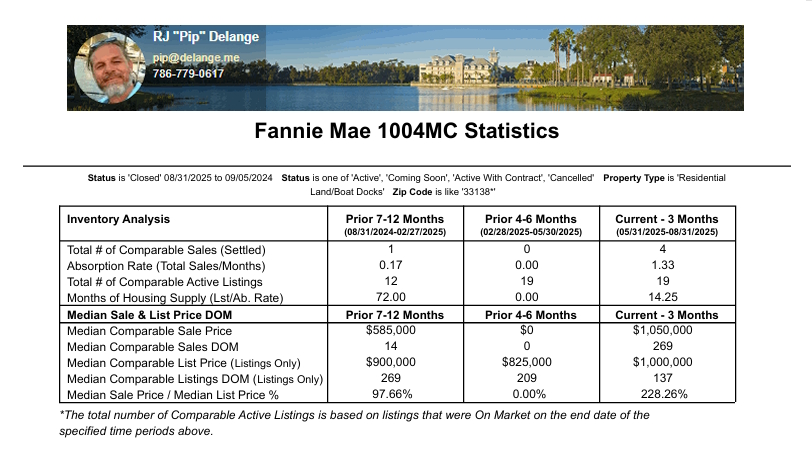

Land & Commercial: Niche but Active

- Land/Boat Docks: Parcels with dockage and clear entitlement remain in play, but buyers demand transparent permitting paths.

- Commercial: User-buyers dominate, favoring logistics or live/work spaces in the MiMo corridor.

Inventory & Supply

- Single-Family Homes: Inventory sits at 7.36 months, up 20% year-over-year. Despite this, renovated homes in desirable streets move quickly.

- Condos: Supply has reached 8.7 months, a clear tilt to buyers. Listings linger unless priced sharply and backed by solid association documents.

The August snapshot confirms that the balance is shifting slowly, with condos already leaning buyer-friendly, while SFH remain relatively seller-favored if in top condition.

Neighborhood-Level Highlights

- Bayside & Belle Meade: Renovated historic homes and gated streets hold their edge.

- Shorecrest: Pricing spreads widen—new $3M builds sell, while older stock stagnates.

- Palm Grove / El Portal: Charm plus modernization is rewarded.

- Condos on Biscayne Corridor: Boutique bayfront buildings with strong reserves outperform legacy towers under financial strain.

What This Means for You

For Sellers:

- Price within the band of the most recent comps.

- Supply HOA docs, insurance quotes, and flood info early.

- Stage homes and lead with professional visuals—buyers want confidence.

For Buyers:

- Condos: Leverage growing inventory and negotiate with full due diligence.

- Single-family: Be decisive on renovated homes—they still sell fast.

- Investors: Focus on small multifamily or SFH rentals as safer bets.

Resources

- Miami-Dade Property Appraiser — Official site

- FEMA Flood Map Service Center — Flood zone lookups

👉 Request the Full 33138 Data Pack (closed sales, actives, DOM, absorption by segment)

👉 Get Your Instant Home Valuation (adjusted for renovation level, flood/insurance, and street context)